Researched by Gifty Danso

The Acting Director General of the State Interests and Governance Authority (SIGA), Prof Michael Kpessa-Whyte, acknowledged in an interview with Bernard Avle that Ghana’s top 10 State-Owned Enterprises suffered a net loss of GH¢11 billion in 2023.

During an interview on March 19, 2025, Avle, the host of Point of View on Channel1 TV said, “10 SOEs with the most assets recorded an aggregate net loss of GH¢11 billion in the financial year 2023, which surpasses the total loss of all 53 SOEs. ECG alone accounted for GH¢10 billion,” with Prof Kpessa-Whyte acknowledging the facts as read out by the interviewer.

On March 3, 2025, during the National Economic Dialogue, Finance Minister Cassiel Ato Forson stated that Ghana’s State-Owned Enterprises were in crisis. News reports on March 13, 2025, quoted the Minister saying that only three SOEs paid dividends in 2023 (find here and here).

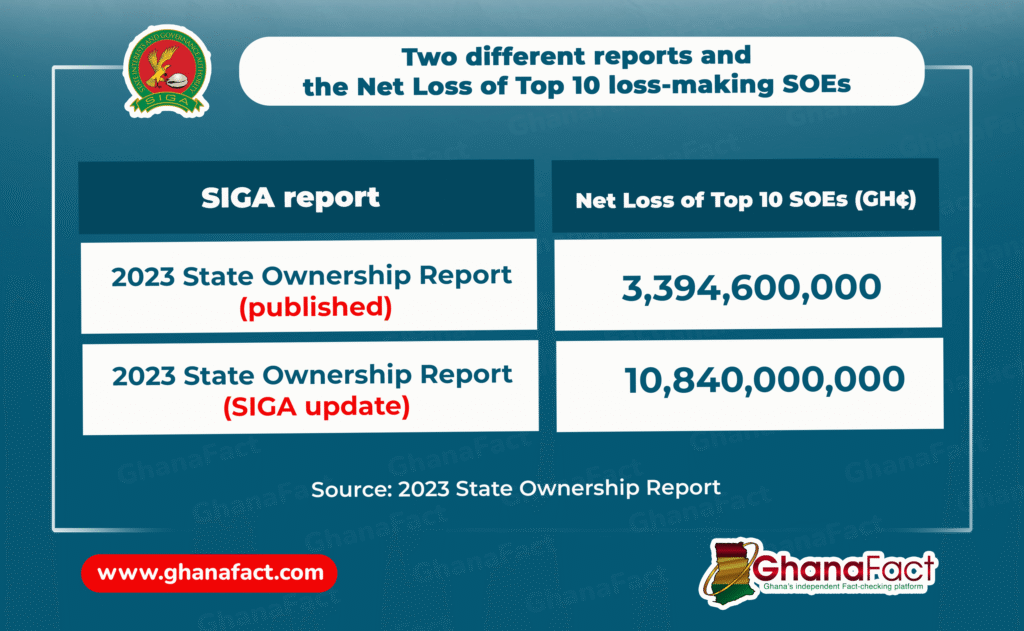

This report presents facts from publicly available data from SIGA and a detailed explanation of how a net loss of GH¢3 billion, as captured in the 2023 SIGA report, ballooned to GH¢11 billion.

Fact-Check

To verify the claim that the top 10 SOEs recorded a net loss of GH¢11 billion, GhanaFact relied on the publicly available 2023 State Ownership Report.

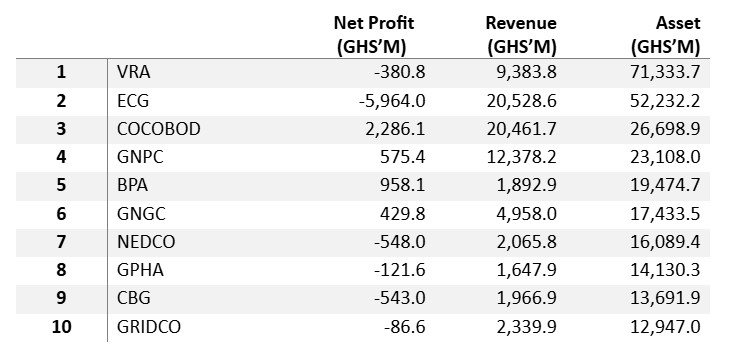

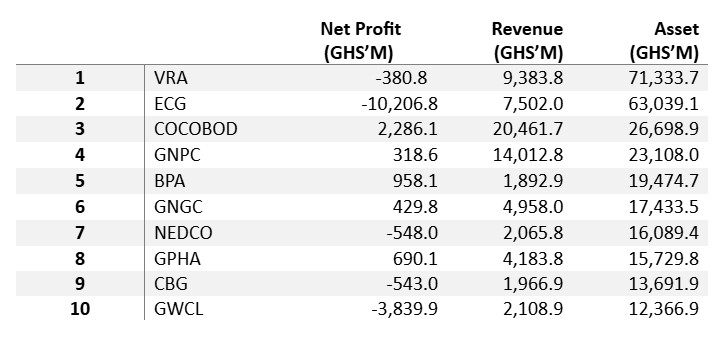

The SIGA report gave details of the top 10 SOEs by total asset-book value as follows;

From the table above, six out of 10 SOEs recorded combined net losses of GH¢-7,643,940,000.00 in the year under review. Four other institutions in the group also recorded net profits to the tune of GH¢4,249,300,000.

To determine the profits or losses recorded by the top 10 SOEs for total assets, we add the combined net profits to the combined net losses.

GH¢ (4,249,300,000 + -7,643,940,000) = GH¢-3,394,600,000.

This final figure is less than the GH¢11 billion net loss figure attributed to Kpessa-Whyte.

SIGA while confirming the net loss data told GhanaFact in an email: “The total aggregate size of the ten (10) entities as shown in Table 1.0 was GHS267.14 billion. This asset size generated an aggregate revenue of GHS77.62 billion and recorded a net loss of GHS3.39 billion in FY2023.

“It is important to note that at the time of reporting in August 29, 2024, four (4) SEs namely: ECG, GRIDCO, GPHA and GWCL submitted unaudited 2023 financial statements for the preparation of the State Ownership Report,” SIGA added in the correspondence.

“These SOEs in total contributed 80.09 percent to the total revenue of the entire Sector in FY2023, with ECG recording the highest. However, they recorded aggregate net loss of GHS3,394.60 million in FY2023, which surpasses the aggregate net loss of the SOE in totality,” (see page 23 of the 2023 SIGA report available to the public).

The report also shows that not all the SOEs within the biggest asset bracket recorded net losses. Bui Power and Ghana Gas (see page 21 of the report) are both noted to have posted net profits year on year from 2019 to 2023.

COCOBOD is reported to have ended its five-year loss-making streak since 2018 to make a net profit of GH¢2,286.08 million in 2023 (see page 20 of the 2023 State Ownership Report).

Accounting for the discrepancy – SIGA speaks to GhanaFact

When GhanaFact contacted SIGA over discrepancies in its publicly available report and what the Acting Director General said in the Channel 1 interview, SIGA acknowledged the shortfalls with an explanation that the 2023 report, as published on their website, had undergone modifications.

“The State Ownership Report was published using both Audited (40%) and Management Accounts (60%) from the SOEs for their financial performance analysis. After publication, entities keep updating their financial statements as and when they are audited and signed.

“The updates are used to update the State Ownership Report (SOR) for relevant discussions, details of which cannot be found in the published SOR.

“After the publication of the 2023 SOR in August 2024, SIGA began to receive some 2023 financial statements whose audit had been completed. Adjustments were made to the data models to reflect the audited financial statements received and enable SIGA to communicate the actual position on performance in various engagements with the media, including the engagement with His Excellency the President and newly appointed heads of SE,” SIGA said in an email to GhanaFact.

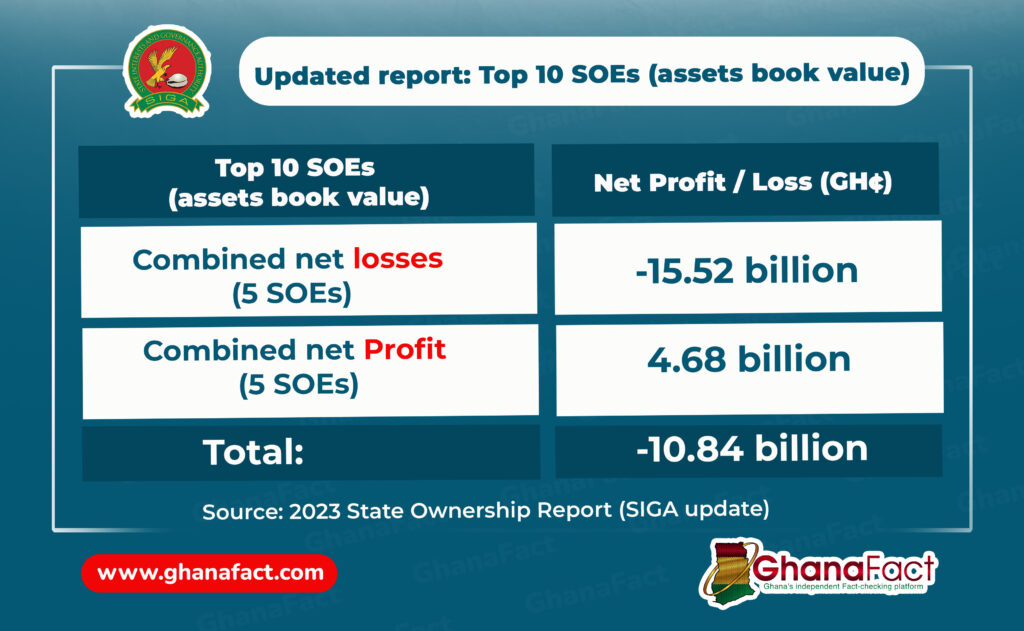

According to SIGA, the adjustments to the SOR report also resulted in changes in the asset size and net losses or profits of the particular SOEs in question. It cited examples of ECG and GPHA, which had their asset sizes appreciating, while GRIDCO’s decreased, pushing it out of the top 10.

“Therefore, the updated top ten entities are VRA, ECG, COCOBOD, GNPC, BPA, GNGC, NEDCO, GPHA, CBG, and GWCL. The aggregate net loss of these 10 SOEs became GHS10.84 billion (rounded up to GHS11 billion in DG’s interview with Bernard Avle; however, this document is not publicly available), and total revenue was GHS68.54 billion.

“ECG’s net loss changed from GHS5 billion per the management accounts, to GHS10 billion in the audited financial statement. GWCL also recorded a net loss of GHS3.84 billion, whilst GPHA recorded a net profit of GHS690 million per the audited financial statement (Mgt Acct: -GHS121m),” SIGA added.

Two different reports and the Net Loss of Top 10 loss-making SOEs

Conclusion

Publicly available records are key to any effective fact-checking process, and to that extent, when records are updated for one reason or another, the necessary agencies must, as a matter of urgency, upload the same and clearly label such documents as such.

To date, the publicly available record of SOE performance is of the old report, which has undergone a massive update that has moved SOE losses from 3.6 million cedis to 10.8 million cedis. Information integrity must be protected with timely and clearly labelled updates to engender quality and fact-based public discourse.