Claim: A Finance Minister borrowed US$11.5 billion from the Eurobond market over five years.

Source: President John Dramani Mahama

Verdict: False

Researched by Gifty Danso

President John Dramani Mahama at the 2025 Africa Business Forum in Addis Ababa (February 17, 2025) claimed the erstwhile Akufo-Addo government borrowed US$11.5 billion from the Eurobond market over a five-year period.

In his submission on the Ghana economy, the President highlighted the amount of money borrowed from the Eurobond market within a particular period promising that his government is focused on economic stability.

“In a crisis, the first thing you do is to focus on stabilizing and so that is what we are focused on…But at the same time too, analyse the factors that got Ghana into this place in the first place and put in the steps that ensure that we don’t end up here again.

“And that would entail looking at the Fiscal Responsibility Act and strengthening it, looking at the Public Finance Management Act and strengthening it; so that tomorrow we don’t have a situation where a minister goes onto the Eurobond market and borrows 11.5 billion (USD) over five years and puts most of it into consumption, those are some of the things we need to look at,” he said. (archived here).

This fact-check will verify the authenticity of the claim relative to how much Ghana borrowed on the Eurobond market and over how many years.

Fact-check

GhanaFact found that the years referenced by the President fall under the tenure of former Finance Minister Ken Ofori-Atta who served as Finance Minister under the previous Akufo-Addo-led government from 2017 until February 14, 2024, when he was removed via a ministerial reshuffle.

During his time in office, Ghana issued Eurobonds on the International Debt Capital Market four times, all within a four-year period (in 2018, 2019, 2020, and 2021).

What are Eurobonds?

Eurobonds are financial debt instruments that allow countries, supranational organisations and financial institutions to access funding needs on cross-border debt capital markets.

Although the Akufo-Addo government chose to abstain from the international debt capital market in its first year in office (2017), it issued its first Eurobond in 2018 on the back of positive economic forecasts and favourable credit ratings.

What does Ghana’s Eurobond borrowing records say?

These are the facts concerning how much the then government raised on the Eurobond market.

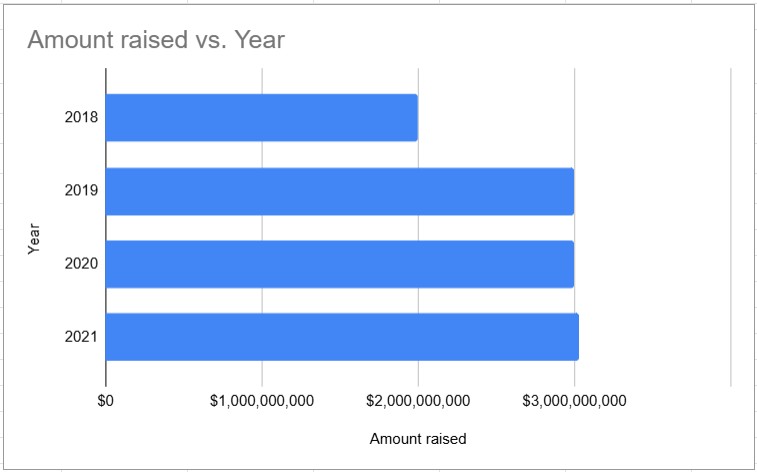

In 2018, the country raised US$ 2.0 billion in 10-year and 30-year Eurobonds of $1.0 billion each.

“On the whole, Government has made significant strides in economic and debt management, namely; Ghana issued its largest Eurobond at the time in the international debt capital markets in May 2018, which proved very popular with international institutional investors; S&P upgraded Ghana from B- to B in September 2018,” page 16 of the 2018 Annual Debt Report stated.

In subsequent years of 2019 and 2020, when Ghana returned to the capital market, it raised $3 billion each for both years to finance energy sector debts and meet budgetary requirements.

“In March 2019, Government also issued a total of US$3,000.00 million in three (3) tranches of 7-year, 12-year and 31-year Eurobonds. The proceeds of the bond as indicated in the 2019 Budget and Economic Policy Statement and the MTDS were to be utilised for budget finance and liability management operations,” Page 17 and 18 of the 2019 Annual Debt Report noted.

Ghana’s last Eurobond issuance was in March 2021, when the government raised another $3 billion before the post-COVID economic slump that meant the country could not borrow any more because of debt restructuring issues and negative ratings.

“In March 2021, Ghana issued her ninth Eurobond on the ICM at a face value of US$3,025.0 million in four (4) tranches. The transaction saw Ghana issue a 4-year zero coupon Eurobond of US$525.0 million, in addition to 7-year, 12-year, and 20-year Eurobonds of US$1,000.0 million, US$1,000.0 million, and US$500.0 million, at coupon rates of 7.750 percent, 8.625 percent, and 8.875 percent,” page 19 of the 2021 Annual Debt Report confirmed.

On June 12, 2024, the Ministry of Finance issued a statement saying it had reached a Memorandum of Understanding (MoU) with its Official Creditor Committee to restructure its bilateral debts, including an outstanding balance of US$13.103 billion in Eurobonds. This $13.103 included US$3.84 billion in Eurobonds inherited from the NDC administration of 2013-2016 and US$11.025 recorded from 2018 to 2021 under the NPP.

| Year | Amount raised | |

| 1 | 2018 | US$2 billion |

| 2 | 2019 | US$3 billion |

| 3 | 2020 | US$3 billion |

| 4 | 2021 | US$3.025 billion |

| 5 | Total | US$11.025 billion |

The figures above show that President Mahama grossly overstated the amount borrowed from the Eurobond market under the Akufo-Addo government.

Verdict

Therefore, the claim by President Mahama that $11.5 billion was borrowed from the Eurobond market in five years is False!

NB: GhanaFact has reached out to the office of the president with our findings and will duly update the report with their input as and when.